Canada’s Open Banking Framework: From Vision to Reality

Momentum Builds as Industry and Regulators Align at Open Banking Expo Canada 2025

Canada’s Open Banking journey hit a major milestone at the 2025 Open Banking Expo Canada. With key legislation passed and the Financial Consumer Agency of Canada (FCAC) now responsible for implementation, the conversation has shifted from "if" to "how fast."

Across keynotes, industry debates, and technical panels, one message came through loud and clear: Canada is building—with trust, collaboration, and purpose.

Building Trust and Digital Sovereignty: A Call to Action

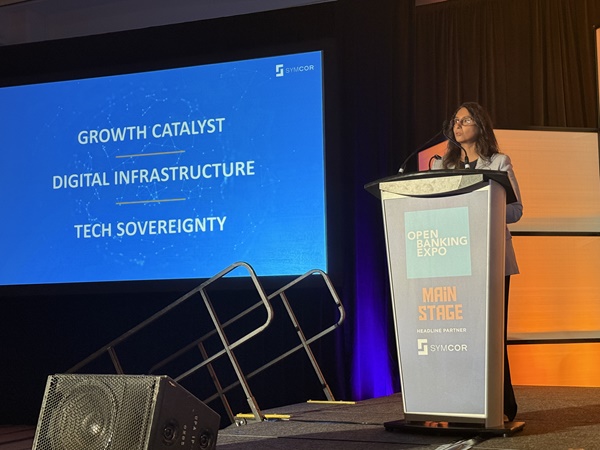

In the opening keynote, Saba Shariff, SVP & Chief Strategy, Product & Innovation Officer at Symcor, reframed open banking as more than a compliance requirement—but a national opportunity.

“This is about giving Canadians the tools, protections, and control they deserve in a digital economy – the benefits of which are clear.”

Shariff emphasized the need to design infrastructure that delivers real value for Canadians—one that supports large banks, empowers fintechs, and most importantly, centres consumers.

Her call to action went deeper than policy: it was about digital sovereignty.

Saba Shariff delivers the opening keynote at Open Banking Expo 2025

“In a knowledge-based world, technology equals sovereignty. And we can’t be digital tenants in someone else’s house. We need to own the infrastructure.”

The message was clear – Canada must not just adopt opening banking, it must own its digital future.

FCAC Steps Up: Protecting Consumers and Powering Innovation

Shereen Benzvy Miller, Commissioner of the Financial Consumer Agency of Canada (FCAC), outlined the agency’s new and evolving role as both regulator and enabler.

With deep knowledge of Canada’s banking system and a commitment to data-driven oversight, FCAC is focused on three pillars: protection, innovation, and trust.

A key concern, she noted, is the continued use of screen scraping—a practice Canadians are largely unaware of, but quick to reject when informed.

“When Canadians were introduced to the concept of screen scraping and given an explanation of how it works… 86% stated that they would rather not use it.”

FCAC’s research highlights a broader issue: a lack of awareness and understanding of Open Banking.

“Our research shows that only 9% of Canadians know what it is, and that awareness is especially low in seniors [and] lower income [groups].”

To address this, FCAC is developing a consumer awareness strategy, grounded in global best practices and real-world examples.

“We’ll have to demystify open banking and demonstrate through real life examples how open banking can give people more control, more choice, and more confidence in their financial lives.”

FCAC Commissioner speaks at the Open Banking Expo 2025

Miller also detailed the foundational elements now underway:

- FCAC’s oversight of the framework and accreditation process

- A public registry and visual trust identifier for accredited participants

- Common rules to ensure privacy, liability, and security

- Coordination with the Department of Finance, technical standards bodies, and other regulators

Looking ahead, Miller previewed the next phase:

- New legislative amendments,

- Supervisory guidance, and

- A cross-government advisory committee

She closed with a vision of a future where Canadians are empowered to control, manage, and share their financial data securely:

“Together, we can develop a framework that doesn't just open doors to innovation but opens possibilities for every Canadian.”

Facing the Roadblocks: What’s Holding Open Banking Back?

During the panel “Canada’s Open Banking Revolution: Accelerating Progress and Tackling Challenges,” leaders from the Canadian Bankers Association, Citi, Borrowell, National Bank of Canada, and Symcor agreed: the technical groundwork is progressing, but regulatory clarity is lagging.

The panel highlighted key challenges:

- High infrastructure costs

- Technical complexity and regulatory overlap

- Lack of interoperability and common standards

- Need for a shared liability model and strong consumer protections

Samantha Tom, VP & General Counsel at Borrowell summed it up:

“We’ve made real progress—Part One of the legislation gave us scope, governance structure, and direction. But we still don’t have enough detail to plan product roadmaps. The big question is: where does this sit on the government’s priority list?”

Natacha Boudrias, Open Banking Lead at National Bank, added:

“Interoperability is not a blocker—it’s an enabler. Standards reduce duplication and accelerate delivery.”

The consensus: to launch by 2026, technical standards, accreditation models, and liability frameworks must be finalized in 2025.

Saba Shariff receives the Open Banking Expo Powerlist – Standout Five Award with industry leaders

Inside the Build: How Canada’s Banks Are Preparing for Open Banking

In a technical session titled “Open Banking & API Banking: Unlocking the Future of Financial Services,” senior engineering and platform leaders from TD, BMO, RBC, and Scotiabank shared a rare look behind the scenes.

Each speaker shared the technical architecture, cyber-resilience, and scalability requirements involved in preparing APIs for live consumer use. The conversation ranged from:

- Microservices deployed in the secure networking zones

- Scalable APIs for unknown consumption loads

- Real-time fraud protection

- Creating secure, developer-friendly sandbox environments

- DDoS prevention and governance controls

Shekher Puri, Vice President, Digital Components and Platforms at RBC explained, “The real power is making sure APIs are drawing from various different elements - used for credit underwriting or having extensions on these APIs for greater flexibility.

I think the final piece to really talk about is the power of APIs that also expose microservices as well. So that can be used within proprietary channels or even external channels as well, as we start to think about embedded finance.”

Kaustubh Srivastava, Head of US Digital Technology at BMO added, “We have spent four to five months on defining the right architecture which can support APIs facing the internet in a secure fashion, being highly available like our digital banking.”

Another key insight: fraudsters are already watching. APIs must be resilient from day one.

The message was clear: Canada’s top banks are not waiting—they are actively building. What they now need is regulatory certainty to move from test to launch.

The Time Is Now: Will Canada Lead or Lag?

In her closing keynote, Author and Public Speaker, Theodora Lau likened Open Banking to an “iPhone moment”—a shift in how we connect, serve, and lead.

“The world is moving on—with or without you. So, the question is: will you sit on the sidelines and be shaped by it, or will you be part of the future and shape it?”

Her words echoed Shariff’s opening call and captured the spirit of the day: collaboration, clarity, and commitment.

Canada’s Open Banking future is within reach. The time to build is now.

Want to learn more?

Curious how Symcor is powering Canada’s open banking future?

Discover COR.CONNECT or speak to our team to learn how we’re enabling secure, scalable innovation.

.png%3Fsfvrsn%3Da13fc238_3&w=3840&q=75)